New Aged Care Reforms - 1 November 2025

Introduction

|

A no worse off principle applies to everyone in residential aged care on 30 October 2025, such that existing residents will have their current arrangements maintained until they leave care. The new arrangements for means testing will only apply to new entrants to residential aged care from 1 November 2025 |

The Aged Care Bill, tabled in Parliament on 12 September 2024, introduced significant reforms aimed at addressing the financial challenges represented by a rapidly ageing Australian population - and the need to place the aged care sector on a stable economic basis. Reportedly, almost 50% of aged care providers were making a loss at the time.

Many of the changes reflected both the Royal Commission and the Aged Care Taskforce reports and a response to a continually growing demand for aged care services and the need for increased investment. The reforms seek to better balance government funding and user contributions - but the approach adopted probably reflects politics as much as economics - with the changes having bipartisan Labor and LNP support.

True reform in Australia is only currently capable within a narrow, constraining ambit, and can't apparently extend to the (much simpler) funding mechanism recommended by the Royal Commission - an aged care levy, although our support for this approach has always been dependent on carving out protection for younger taxpayers in terms of funding.

The summary below is intended as providing a very brief introduction to the major reform changes. Note that while the changes were originally due to come into effect until 1 July, 2025, the Government announced in early 2025 that, "Following careful consideration, the Government will recommend to the Governor-General, Her Excellency the Honourable Sam Mostyn AC, that she proclaim the commencement of the new Aged Care Act to be 1 November 2025.".

We regard the changes as adding additional complexity to an already Byzantine system - with multiple tiers and bi-annual indexation of many factors - making it absurdly complicated for mere mortals. Many figures are also dependent on an individual's "daily means tested amount" and that suggests an unlikely level of accuracy and sophistication.

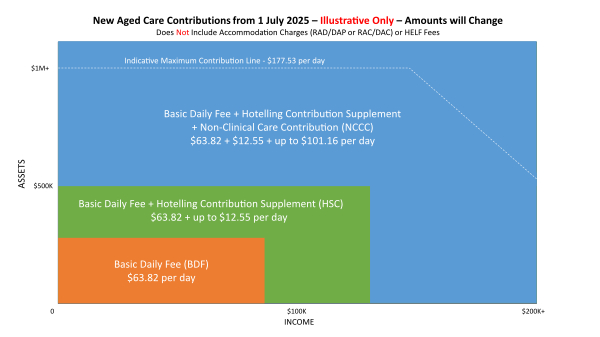

To provide you with a summary cost overview, the Chart below looks at service - not including accommodation - costs for an individual in residential aged care from 1 November, 2025 based on their income and assets (daily means tested amount). As an example, we estimate the annual services cost for an individual with assets exceeding $1M will be around $65,000 per annum, with accommodation costs (RAD/DAP/RAC/DAC) payable in addition. These are substantial costs and the fact that many factors will be indexed and subject to means testing making the whole system complex and difficult to track/manage for the families involved.

A. Residential Age Care Accommodation Fees - Major Changes

It should be noted that there is "no change to who is eligible for government support with accommodation costs" and the treatment of the family home will be unchanged, with only the first $210,555.20 currently assessable for means-testing.

1. Increasing the maximum RAD approval cap to $758,627 - with the cap level indexed to CPI

This will lead to an immediate bump in average RADs as providers pricing at the old $550,000 boundary relish "frictionless" pricing.

2. Apply a retention (non-refundable) amount to RADs and RACs up to 10% over the first five years - that is to say 2% of the RAD/RAC per annum, debited monthly

It will be interesting to see how financing via RAD and DAP now compare. Note that the retention amounts will be calculated daily on the RAC/RAD balance at 2% per annum. We would have preferred that the 2% was calculated on the original RAD payment - slightly more expensive for individuals but at the least the payment amount would have been easy to track and substantiate. Daily calculations are just absurd.

3. Index DAPs in line with CPI every 6 months.

Previously, the same DAP applied for the duration of an individual's stay in accommodation. Now that this no longer applies and the amount is subject to indexation comparing DAP vs RAD financing will be interesting - but note that DACs will not be subject to indexation, it is not clear why and it just adds another element of complexity and apparent inequity.

4. Consider eliminating new RADs from 2035.

We have never liked RADs as a funding mechanism for aged care accommodation so we support their elimination in principle, but this is just purely "aspirational" at the moment and not worthy of applause. DAPs are still left as a highly volatile funding mechanism because they are linked to interest rates through the MPIR and now this is exacerbated to some degree by indexation. There is also little logic behind indexation, other than as a route - like the 2% per annum retention for RADs - to increase fees to providers.

B. Residential Age Care - Daily Fees - Major Changes

Daily Care fees in residential accommodation will be divided into three categories and attract the following fees.

1. Everyday Living Costs - BDF

All residents are currently required to pay a Basic Daily Fee (BDF) which is set by government at 85% of the single base rate of the Age Pension. This contribution partially funds services like meals, cleaning and laundry.

The BDF has not changed under these reforms. Fully supported residents will continue to only pay the BDF, and partially supported residents will continue to only pay the BDF and a contribution towards their accommodation costs (ie DAC/RAC). The BDF as at 1 November 2025 is $65.55.

2. Hotelling Supplement Contribution - HSC

Residents who have more than $238,000 in assets, more than $95,400 in income or a combination of the two, will make additional contributions towards their everyday living costs. This Hotelling Contribution (HC) will be calculated as 7.8% of assets over $238,000 or 50% of income over $95,400 (or a combination of both), up to a daily limit on the HSC of $12.55 ( as at 1 November, 2025 - $4580.75 per annum).

3. Clinical Care

The Government will fund all clinical care. A Quality Standard has been developed with respect to Clinical Care within Aged Care so we would expect that there are clear boundaries delineating between clinical and non-clinical care, but we can't express confidence yet.

4. Non-Clinical Care Contribution (NCCC)

A Non-Clinical Care Contribution has been introduced to cover non-clinical care costs such as bathing, mobility assistance and provision of lifestyle activities. The Means Tested Care Fee (MTCF) will be abolished for new residents but replaced by another means testing system of only slightly less complexity, resulting in "residents with sufficient means" contributing 7.8% of their assets over $502,981 or 50% of their income over $131,279 (or a combination of both) up to a daily limit of $105.30 (or $38,434.50 per annum).

There will be a Lifetime Cap - the non-clinical care contribution will only apply for the first four years or to a dollar limit of $135,318.69, which will be indexed by CPI twice per annum.

C. Home Care Fees - Major Changes

The new "Support at Home" program incorporates the following major changes:

1. Services will be divided into three categories, which parallel the approach in residential care - Clinical care, Independence support and Everyday living costs.

2. Care will be approved under 10 package levels, with the highest level having a higher budget than the current Level 4 package.

3. In terms of Fees:

- Clinical care will be fully paid by government.

- Full pensioners will pay 5% of independence support costs and 17.5% of everyday living costs. Self-funded retirees will pay 50% of independence support costs and 80% of everyday living costs. Part-pensioners or recipients of the Commonwealth Seniors Health Card (CSHS) will pay between these levels with means-testing (assets & income) that aligns with age pension means-testing rules.

- The lifetime cap for client contributions will increase to $135,318.69 (indexed) and count towards residential care cap - see above. Individuals who start a Home Care Package after 30 June 2025 will only be able to accumulate unspent funds of up to $1,000 or 10% of package budget (higher of) across quarters.

D. Two Future Reviews

The Government has also committed to conducting two Independent Reviews:

1. Review of Accommodation Pricing

This review will assess the adequacy of the current accommodation supplement provided to low-means residents and consider potential incentives for providers to offer and maintain high-quality accommodation. This will include strategies to encourage provider acceptance of low-means residents, the potential for the DAP to become the default payment method, and the relationship between RADs and DAPs. The Government is required to table a written report of the review in Parliament no later than 1 July 2026.

2. Review of RADs

This review will examine the operation of RADs as both a payment method and a source of capital for residential aged care, including the feasibility of transitioning away from RADs over time. The review will consider a potential phase-out, contingent on sector readiness and access to alternative funding. The Aged Care Act requires the Government to table a written report of the review in Parliament no later than 31 March 2030 (!!)

If you would like to arrange professional advice in relation to the above matters, please complete the Inquiry form below providing details and you will be contacted accordingly. You will receive a fee quotation in advance of any advice or services being provided.

Please note prior to making any Inquiry: Financial regulations regarding the provision of specific advice mean that it is impossible for us to provide assistance unless it is provided as part of paid professional advice. If your circumstances are not complex and don't require paid professional advice you should direct any queries in relation to the aged care directly to Myagedcare. We reserve the right in this area not to respond to Inquiries that don't meet the above requirements - as we receive many inquiries that choose to ignore our comments above. |