An Introduction to Australian Superannuation and Pensions

As we mention elsewhere, planning for your retirement should not just include focusing on your superannuation balance, but ensuring that you have adequate and appropriate assets in total to meet your retirement income needs. Regardless, outside home ownership, superannuation is already the second most substantial asset held by Australian families, and its importance will grow over time.

Obviously, it is also the only investment which is specifically structured to provide you with financial support in retirement and it provides a very tax effective environment within which to grow investments. The following section provides you with a summary introduction to superannuation in Australia, including an explanation of how you can contribute to superannuation, how superannuation is taxed and when you can access your funds.

The focus of this website is very much upon providing information and support for fully and partially self-funded retirees, and helping them navigate the superannuation and social security systems. At the present time, according to the most recent ABS statistics, about 55% of the retiree population, or about 2.3M individuals, are now either fully or partially self funded on retirement (see the chart below) and this will increase over time.

Indeed, these figures are probably underestimates, since the majority of the 12% who are recorded as having no personal income are likely to be the spouses of fully self-funded retirees who do not qualify for the Government pension by virtue of the asset or income test.

To be frank, superannuation is overly complex, largely for reasons of politics rather than good policy, and unless your situation is relatively simple you cannot be expected to have a full appreciation of how superannuation affects you and your available options. For that reason, we strongly recommend that you consider seeking experienced financial planning advice earlier rather than later, and certainly in the decade prior to your planned retirement - your fifties for most people.

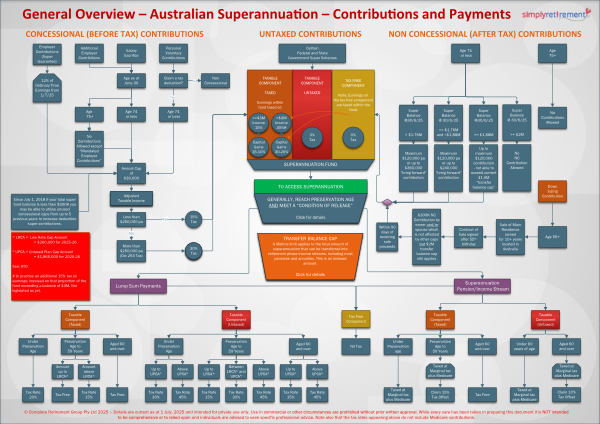

The relative complexity of superannuation is illustrated by the schematic or "simplified" flow chart of superannuation which we have constructed; and this is not a complete overview. It doesn't for example cover certain specific areas, such as co-contributions, or the departing Australia superannuation payments (DASP) available to some temporary residents. It is not intended as an alternative to discussions with either your financial advisor or Centrelink, but to provide some help in putting the whole, complicated system in perspective.

If you would like to arrange professional advice in relation to the above matters, please complete the Inquiry form below providing details and you will be contacted accordingly. You will receive a fee quotation in advance of any advice or services being provided.