How is the Family Home assessed on entering Aged Residential Care?

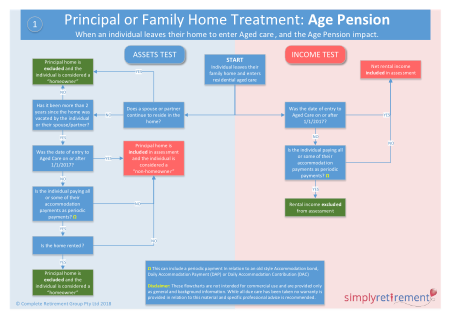

This is quite a complex question, and the treatment of the family home for both the Age pension and Aged care fees can depend on when an individual entered aged care. Asset and income tests apply in both areas, but differ slightly in terms of their treatment of the family home.

Note in this context that an individual is considered a "homeowner" if they or their partner have:

- a right or interest in their principal home, and

- the right of interest gives them reasonable security of tenure in the home.

Consequently, the notion of the "family home" can extend beyond a standalone property or unit/apartment to include granny flats and retirement village units. In the case of special residences, such as a retirement village unit, a pensioner is considered a homeowner if the lump sum amount they paid for their home, known as the entry contribution (EC), is greater than the "extra allowable amount" (EAA) at the time of payment. The EAA is the difference between the single homeowner and single non-homeowner thresholds; the current rate applying is $242,000 as at March 20, 2024.

Because of the complexity, and the dependence on an individual's circumstances, we very much recommend professional advice. To provide you with an overview however, we have provided a flowchart below detailing how an individual's family home will generally be treated in terms of the income and assets tests applying in relation to both the Age pension and Aged care.

If you would like to arrange professional advice in relation to the above matters, please complete the Inquiry form below providing details and you will be contacted accordingly. You will receive a fee quotation in advance of any advice or services being provided.