The SimplyRetirement Age Pension Calculator

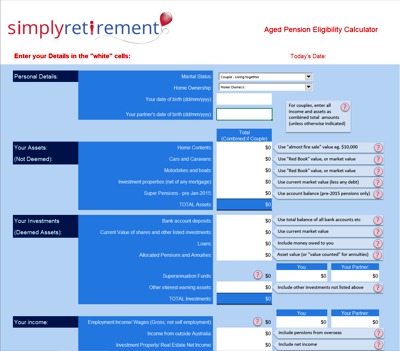

Calculating your Age pension entitlement, whether full or partial, can be quite complex depending upon your individual circumstances. As you will appreciate, both and Assets and Income tests apply, and it is the lower pension applicable under either tests that will apply to individuals. To assist individuals and families in calculating their age pension entitlement we have created an Excel based pension calculator which is downloadable from this page, current as at September 20, 2025.

Note that while the Government has announced changes to the deeming rate thresholds, it has yet to announce any changes to deeming rates themselves. Should there be changes we will update the calculator accordingly.

Before using the calculator you must read and make sure you understand the information above, as well as in the 'Disclaimer' tab on the front page of the calculator. The fact that this a downloadable calculator means that your privacy is maintained - neither we nor anyone else collects information regarding entries to the spreadsheet - and you should find it easier to model different situations.

SimplyRetirement Australian Age Pension Calculator |

The calculator is not intended as an alternative to discussions with either your financial advisor or Centrelink but, consistent with our approach throughout the site, it is intended as providing you with information so that you are better prepared for these discussions. As far as practicable, we will adapt this spreadsheet so that it remains current in terms of pension levels and changes to any of the test criteria, but we do not not provide a warranty or guarantee in relation to the accuracy of the spreadsheet - and it contains a disclaimer to this effect.

| The calculator is free for personal use, but may not be used within any commercial, business or government enterprises without SimplyRetirement's prior written approval; downloading the calculator is conditional on your agreeing that it will not be used for commercial purposes. Please also note that no technical support or advice will be made available in relation to the use of the calculator. |

About our Calculator

- The calculator functionality is based on the Centrelink assets and income test methodologies, and updated when the published threshold values change (generally in March and September each year). For an explanation of these thresholds and methodologies, please refer to our explanation of how the income and assets tests are applied, and the Australian Government's Department of Human Services website.

- Use the

button at any time whilst using the calculator – you will be taken to the relevant section of these guidelines to help you complete the calculator correctly.

button at any time whilst using the calculator – you will be taken to the relevant section of these guidelines to help you complete the calculator correctly. - If you are a member of a couple, you should enter all income and asset amounts (except as otherwise indicated) as total combined amounts - that is, include all of your partners income/assets with yours (even if only one of you is eligible or potentially eligible for the Age Pension).

- The calculator, and output, assumes you meet the Age Pension residency qualification requirements.

Completing the SimplyRetirement Age Pension Calculator

- Your home as an asset: if you own (or are paying off) your own home it is generally exempt from the assets test, and so should be excluded from the calculator - note however that there are some exceptions to this rule.

- Assets are either deemed or not deemed - financial assets such as money in bank account or term deposit are assumed (deemed) to generate certain levels of income. As an example, if you have $25,000 invested in a bank account, it is not the interest received from this investment that is counted towards the Income Test, but rather the amount that this $25,000 is deemed to earn (using the current deeming thresholds and rates published by Centrelink). The calculator automatically calculates your deemed income from your deemed assets and uses this calculated value in your Income Test.

Please complete the appropriate sections of the calculator as follows:

For Non-deemed assets:

- Home contents: This is "almost fire sale" value (less than $10,000), not insured value.

- Cars and Caravans; motorbikes and boats: use market value, such as provided in the Redbook.

- Investment properties: use current market value, less any debt secured against the assets. Read more about the valuation of real estate assets here.

- Super Pensions - pre Jan 2015 (for account based pensions commenced between 1/1/2010 - 1/1/2015): Effective 1/1/2015, new Age Pension income test rules were introduced whereby pension balances were "deemed" to earn an income, and this income is included in the Income test. However, superannuation pension products held by pensioners before 1/1/2015 are "grandfathered" indefinitely and continue to be assessed under the previous rules for the life of the product. The "grandfathered" rules mean that: (i) the account balance counts towards the Assets test; and (ii) for the purposes of the income test, the income that is counted is generally the pension payments received for the year less a deductible amount (that represents a return of capital). Read more about how the deductible amount is calculated here.

For Deemed assets:

- Bank account deposits: the total current balance of all funds held in bank accounts

- Current value of shares and other listed investments.

- Loans: include money owed to you (eg. family loans, company loans).

- Allocated pensions and annuities (see also "Super Pensions - pre-Jan 2015", above): include the asset value (or "value counted" for Complying Annuities)

- Superannuation funds: The asset value of funds in superannuation are included in the Assets test only if you or your partner have reached the Age Pension age - otherwise these amounts are excluded from the calculation

- Other interest earning assets: may include other investments not listed above eg. shares and securities not publicly traded,reverse mortgages and overseas investments.

For Income

- Note that all income should be included on a gross annual (before tax) basis

- Employment Income/ Wages (gross; not self employment): Centrelink provide a Work Bonus Scheme for all pensioners over Age Pension age if they have "employment income". Accordingly, you should enter any income derived from employment here - the calculator will automatically calculate your entitlement to the Work Bonus Scheme. Note however - the calculator can not allow for work bonus income you may have accrued in the "work bonus bank" through unused work bonus allowances (where you may be eligible for additional work bonus credits of up to $4000). You will need to check your precise position directly with Centrelink.

- Income from outside Australia

- Investment property/Real Estate income: include net income (i.e. gross rental income less costs)

- Other income, income streams: Include any other income not included above, including income from self employment (see above "Employment income/ wages").