Types of Superannuation Contributions and Caps

Contributions made to an Australian super fund are divided into two types: Concessional (pre-tax) or Non-Concessional (after-tax). Both are subject to specific contribution limits or caps - usually of an annual nature, but sometimes multi-annual. The Tables below summarise these two types of contribution and the current applicable caps and some significant changes which have taken place in recent years.

The most significant change was to place a cap of $1.6M, which subsequently increased to $1.7M on July 1, 2021, $1.9M from July 1, 2023 and $2M on 1 July, 2025, on the amount of total funds which can be held in pension phase account and fund an income stream which attracts no tax. This is called the Transfer Balance Cap (TBC).

Concessional Contributions - In Summary

These include:

- Superannuation Guarantee (SG) contributions

- Additional employer contributions

- Salary sacrifice contributions and

- Contributions made by the self-employed if they meet deductibility rules.

| Concessional Contributions : Annual Cap - From July 1, 2021 | |

| Regardless of Age | $27,500 |

| Concessional Contributions : Annual Cap - From July 1, 2024 | |

| Regardless of Age | $30,000 |

Catch Up Payments from July 1, 2018

If you have less than $500,000 in your super account at the prior June 30, you can make catch-up payments if you haven't used up your concessional contribution annual limit. Unused cap amounts can be carried forward for up to five years before they expire..

Spouse Concessional Contributions

Since July 1, 2017, you have been able to make contributions to your spouse’s super. Currently, if they earn up to $40,000 a year and are aged under 75, you will receive a low income spouse offset of up to $540 a year.

Personal Super Concessional Contributions

Since 1 July 2017 individuals have been able to make personal super contributions. If you claim a tax deduction for them, they are regarded as concessional contributions and are taxed in the fund at a rate of 15%. If you don't claim a tax deduction for them, then they are regarded as non-concessional contributions and are not further taxed. They are subject to respective concessional and non-concessional caps.

Tax Treatment

Concessional contributions (CC) are typically subject to a tax of 15%. The exception is when your adjusted taxable income was greater than $300,000 up until 30 June 2017, or $250,000 from that date forward; these contributions are subject to an additional tax of 15% (equating to an effective tax rate of 30%).

Total concessional contributions from all the sources above cannot exceed the above annual cap - if they do then the additional contributions are taxed at your marginal tax rate, plus an interest charge - although you can choose to withdraw the excess contributions.

What if you exceed your Concessional cap contribution? Bearing in mind the changes effective from July 1, 2018, which may provide you with some additional "headroom" if you have less than $500,000 in your super fund, any excess contributions will be taxed at your marginal tax rate, plus an interest charge called an Excess Concessional Contribution Charge (ECC) . The excess contributions are eligible for a 15% tax offset, to reflect the fact that a 15% contributions tax has already deducted from the contribution upon entry to the super fund.

Non-Concessional Contributions (NCC) - In Summary

These include all contributions made from sources which have already been subject to tax, and include foreign pension transfers - except that part of the pension capital value which reflects growth since the date of residency - and Government co-contributions.

| Non-Concessional Contribution Caps - From July 1, 2021 | |

| Annual | $110,000 |

| Bring Forward Basis (3 Years) | $330,000 up to and including age 74 |

| Non-Concessional Contribution Caps - From July 1, 2024 | |

| Annual | $120,000 |

| Bring Forward Basis (3 Years) | $360,000 up to and including age 74 |

Note that the NCC caps are a function of the annual Concessional Contributions Caps - a multiple of 4 times the cap.

Downsizing Contribution - From 1 July, 2018

From 1 July, 2018 individuals who owned main residences in Australia for a period of 10 years or more at the date of sale, have been able (in concert with their partners/spouses even if they have not been joint owners) were able to make a non-concessional contribution to super of $300,000 from the proceeds of the sale of the residence, referred to as a "downsizing" contribution - subject to any contribution being made into super within 90 days of sale. With effect from 1 July, 2022 the eligibility age to make downsizing contributions into superannuation was reduced to 60 years of age,and then further reduced to age 55 on 1 January, 2023.

Transfer Balance Cap

If your total super balance is at or over the current Transfer Balance Cap ($1.9M as at July 1, 2023 and $2M from July 1, 2025) then you aren't able to make any further non-concessional contributions to your super.

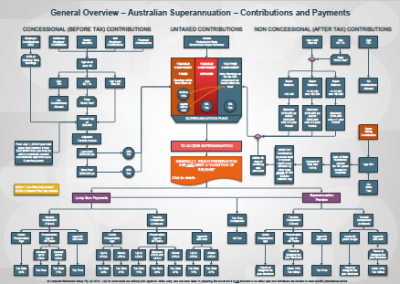

An Overview

Within a relatively short period we have created a retirement savings system that ranks very highly in world terms, but is exceptionally complicated in many respects. Just how complicated is illustrated by the schematic overview of the super system available for download below.

Before using the schematic you should read and make sure you understand the information above and note that it is intended only as background information for individuals; it is not intended as an alternative to discussions with either your financial advisor or Centrelink and nor is the schematic intended to represent a complete overview. Consistent with our approach throughout the site, the intention is to provide you with information so that you better understand your own position prior to obtaining professional advice. It is free for personal use, but may not be used within commercial enterprises without our prior written approval.

If you would like to arrange professional advice in relation to the above matters, please complete the Inquiry form below providing details and you will be contacted accordingly. You will receive a fee quotation in advance of any advice or services being provided.

| Please Note: If your circumstances are not complex and you don't require paid professional advice then any queries in relation to Superannuation should be made directly to your Super fund trustee. |