Debt and Retirement shouldn't go together...

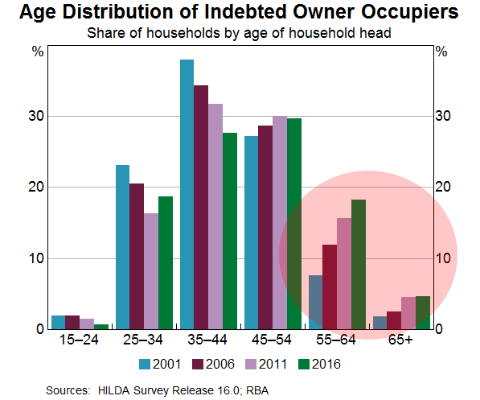

Ideally, individuals and couples should aim to be debt free on retirement - the family home "provides tangible financial security and reduced living costs if fully owned on retirement". However, as we mention elsewhere on the site, RBA data clearly shows that the proportion of individuals aged 55+ with mortgages has more than doubled in the period from 2001 - see the chart below.

More recent data is unfortunately difficult to access, but the prevalence of new home buyers being assisted by the "Bank of Mum and Dad" suggests that retiree indebtedness is probably increasing significantly.

|

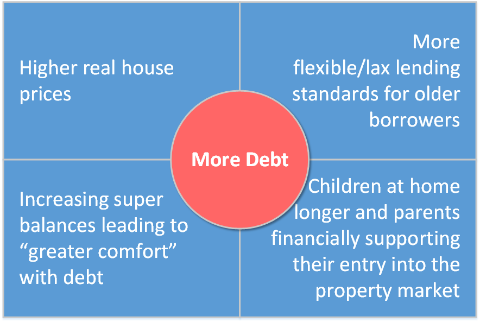

To a degree, this may reflect extended working lives and a greater acceptance of debt, perhaps premised on a "forever rising" real estate market, but we believe there are a range of factors at play, including those in the illustration below, including previous lax lending standards, increasing super balances and assistance being provided to children. In any event, having debt decreases your resilience to major shocks, such as pandemics or major economic downturns which can significantly impact asset prices.

|

We also need to consider to what degree the principal home exclusion in the pension assets test and for capital gains tax purposes is distorting the real estate market and the assets held by both current and future retirees. Additionally, while some of this debt will include investment properties and may therefore be "good debt", there will doubtless be situations where retirees have over-extended themselves financially, often after receiving "professional advice", which will leave them very exposed in a market downturn and/or when interest rates increase.

Whatever the reasons, this trend needs to be carefully followed and addressed if necessary. Retirees looking to invest in property also need to be aware of a potential "double whammy".

The "double whammy" - the impact of using your principal home as security for an investment

Note the following extract detailing how money generated from a mortgage taken out against your principal home - which is itself exempt from inclusion in the assets test - is considered for asset test purposes.

|

"If a loan is secured against your principal home and is used to purchase another asset, the value of the outstanding loan cannot be deducted from the value of the purchased asset. This is because your principal home is an exempt asset under the assets test, and this exemption cannot be transferred to other assets which are assessable. Loans secured against other disregarded or exempt assets are treated the same way. However, there are some instances where a mortgage against your principal home may affect the value of your assets. For example, if you take out a secured loan or mortgage against your principal home, and then lend this money to a private company, business or trust or to a person other than your partner, then the loan amount may be counted under the assets test. This is because under the assets test, loan amounts which remain unpaid are still treated as assets." https://www.dva.gov.au/factsheet-is106-loans-and-mortgages |

In summary, if you use your principal home as security to purchase another asset, or to access cash which you lend to family member or anyone else, then you will risk:

- Potentially diminishing the security afforded by a fully owned principal home, and

- Giving rise to assets that will count towards the assets test, with no offset available for the debt that you have created - potentially reducing both your pension and increasing your living costs in one transaction.

In short, proceed very carefully, and seek prior professional advice, before taking on debt close to or during retirement.

If you would like to arrange professional advice in relation to the above matters, please complete the Inquiry form below providing details and you will be contacted accordingly. You will receive a fee quotation in advance of any advice or services being provided.