Division 296: Superannuation Tax Changes - 16/10/25

Earlier this week the Australian government announced substantial changes to the proposed Division 296 tax, which is intended to apply higher tax levels to significant superannuation balances.

The most important changes announced were as follows:

- Threshold and Timing - it was confirmed that the threshold for Division 296 tax would remain at $3 million, but that the new tax would now commence a year later than planned, on 1 July 2026.

- Realised Capital Gains - the calculation of earning will now only include realised capital gains and income, in line with existing tax approaches. The previous proposal would have captured unrealised gains and this was perhaps its most controversial aspect.

- Tax Rates - the tax rate has been set at 30%, applicable to earnings attributable to the portion of a member’s balance exceeding $3 million, compared to the normal 15% for any balance under this threshold. A new tax tier of 40% was also introduced for any portion of the balance over $10m.

- Indexation - contrary to the first proposal, the thresholds will now be indexed to CPI. For the $3 million threshold this will occur in increments of $150,000 and for the $10 million threshold, in $500,000 increments.

These changes will impact very few Australians, but will introduce some greater equity and fairness into the administration of super - there are a small number of Australians and their families who have super balances far in excess of levels necessary for retirement and super has effectively been used as a tax shelter, at the community's expense. The introduction of the 40% is likely to (rightly) see a prompt reduction in the number of large funds with balances over $10M.

Equity and Fairness in the Tax and Aged Care System - August 31, 2025

We have, for a number of years now, expressed the view on this website that changes need to be considered in the tax system that addressed what is referred to in the press as intergenerational inequity. In short, various aspects the Australian tax system, especially the treatment of capital gains, advantages the older generation over the younger generation. The tax rates applying to younger people versus older people on the same income is often demonstrably higher in many situations. The playing field has been tilted over many years in favour of the older generation.

Our approach has been premised on need for fairness, and a practical realisation that changes are better made in a balanced environment outside of a crisis - which demographics suggests is possible.

However, one issue bridges across both the tax and social security system, and that is the treatment of main residences. Under both these systems, this particular type of asset is not subject to capital gains tax or considered in the context of eligibility for the age pension. This is a consequence of politics, not of economics. You have political system which appears to have accepted the view that any attempt to broach the “sanctity” of the main residence is tantamount to political death.

Yet it leads to extreme inequities; there are thousands of individuals across Australia living in properties worth millions of dollars drawing a full pension. When they die, the value of that property is often then passed on to their relatives with no capital gains tax applicable. You are having millionaires maintained for many years at the taxpayer’s expense, which is entirely what the assets test is supposed to preclude.

This needs to be reconsidered given that we now have tools for extracting an income from house value, in the form of the Home Equity Access Scheme (HEAS). Individuals who used to be asset rich, income poor, can now convert their home value into an income stream comparable to or greater than the age pension. There is now no excuse for contemplating a situation in which the value of houses over certain amounts, based on specific cities and regions, is not included in the assets test.

This would be much more equitable than seeking to “nickel and dime” eligible pensioners living in much more modest circumstances.

Additionally, why do politicians seem to treat aged care policy with less sensitivity than the NDIS. For years access to aged care support has depended on a very precise and (overly) complex means testing process, with individuals making contributions where the circumstances allow. Not so the NDIS which has never been subject to means testing or anything approaching stringent budget processes.

As a consequence NDIS spending is threatening to exceed defence spending and politicians are just now finding out that it’s harder to withdraw support than have reasonable gatekeeping requirements in the first place. It’s hard to contemplate a service introduced with such poor or non-existent controls and how much it has given quickly rise to an apparent sense of entitlement in some members of society.

Having a different approach to aged care and NDIS spending is simply inequitable, and there is an overlap - uncontrolled NDIS spending has clearly crowded out aged care services. Just getting a budget for a home care services is difficult enough, without then trying to find a provider, who often finds it (much) more profitable to deal with the NDIS. Since mid-2023, the waitlist for home care packages has grown by approximately 9,000 people per quarter; as at December 2024, 82,960 individuals were awaiting a package at their approved level.

In summary, fairness should certainly drive any assessment of tax policy, including intergenerational fairness, but equity and fairness should also drive the government’s provision of services - whether NDIS or aged care.

Division 296 Super Tax Commentary - June 19, 2025

There has been a lot of press attention recently devoted the new Division 296 tax, which proposes tax changes for individuals with the total superannuation balance above $3 million. Effectively increasing tax on superannuation above those levels from 15% to 30% in the accumulation phase.

Any new taxation invariably attracts opposition, despite the fact that a very small proportion of the population have superannuation balances exceeding $3 million. The major concerns are been over the fact that the government doesn’t intend to index the $3 million amount, which means that more people over time will be impacted, and because the legislation may see the taxation of unrealised capital gains.

This is not a particularly “pretty” tax in terms of its implementation, and it further complicates any understanding of superannuation, but it clearly flags are designed to cap the community cost of superannuation. Our view is that this action should have taken place years ago, but as part of a more extensive reform process, ideally linked to general tax reform.

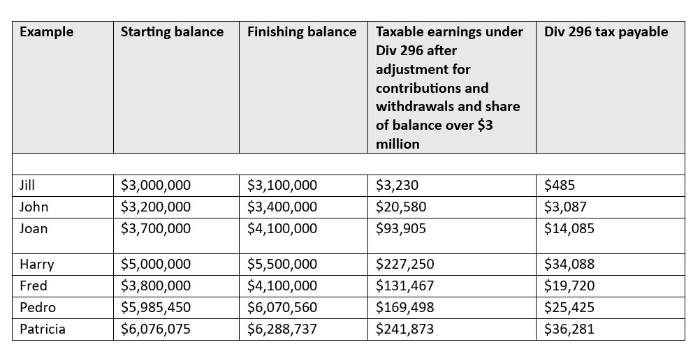

But despite the hullabaloo of the press, and the LNP, when it comes to the individual impact of the tax it’s probably less significant than you would expect. Recently, the Association of Superannuation Funds of Australia (ASFA) has provided a Fact Sheet containing seven worked examples of how the tax would apply. Given the income and asset levels, and we would argue that the additional taxation applicable is neither startling or unwarranted.

|

Changes to Aged Care Accommodation Payments from 1 July 2025 - March 13, 2025

It's worthwhile reminding people that there are a number of substantive changes being made to payments for residential aged care from 1 July 2025.

Individuals have a choice when it comes to paying for residential aged care of either paying a residential accommodation deposit (RAD), daily accommodation payment (DAP) or a combination of both). The major difference between a RAD and a DAP was that the RAD was fully refundable, and the DAP was not refundable at all.

This will change from July 1, when individuals who enter residential aged care from that point in time onward, will have 2% of their RAD deducted annually for up to 5 years - a maximum 10% reduction in total. This approach will also apply in relation to residential accommodation contributions (RACs)

Similarly, the DAP was always calculated by reference to the maximum permissible interest rate (MPIR) at the date of entry to residential aged care, and this MPIR would not change throughout their residency. From July 1, 2025 the DAP will now be subject to indexation by CPI. However, indexation will not apply in relation to daily accommodation contributions (DACs), and no explanation has been provided as to why this is the case.

Note that on the basis of the Government's " no worse off principle " these changes won't apply to residents who enter residential care before 1 July 2025 . In practice, someone is worse off, and that is anyone who has to already find their way through a complex maze of policy, which is made much worse by the continual "grandfathering" of benefits. Complexity introduces direct and indirect costs and politicians need to find a way to better manage sensibilities than making constant exceptions that build up like guano.

Retirement villages are earning a lot of media attention - October 24, 2024

The terms and conditions surrounding retirees in retirement villages in Australia are - somewhat belatedly - attracting a lot of media attention at the moment. That is a good thing, leading to a greater awareness about the need to very carefully review any contract prior to entering into a retirement village. We strenuously recommend that individuals obtain prior legal and/or financial advice prior to making any commitment to a retirement village.

We deal with the issue in more detail elsewhere, and have done over a number of years, but individuals and couples need to appreciate that there are good and bad operators in the industry, and adopt a "buyer beware" approach - this is a very significant financial decision and needs to be approached accordingly.

AustralianSuper - yet to prove that "bigger is better" - September 30, 2024

We have just updated our article on AustralianSuper, including the most recent investment performance information.

In short, Australian super continues to provide no evidence that being larger benefits members, whether we consider investment performance, the quality of member services or product innovation.

In many ways, it's unfair to use Australian super as a "lab rat" in this situation, because there is always going to be an intrinsic volatility in investment results, but it trumpeted the advantages of size - and when it comes to performance, they just don't seem to be delivering in terms of relative performance. This is an important issue when it comes to the government and community's attitude to further rationalisation in the Superannuation sector - and in particular whether fund mergers are really to the benefit of members or simply the funds themselves.

Deeming Rates Frozen - the Most Significant Budget Item for many Pensioners - May 22, 2024

In perhaps the most important announcement for pensioners in the recent Budget, the government announced it would continue to freeze the deeming rate for another year - until June 30, 2025. The deeming rate is the rate of return the government assumes retirees will earn on their investments, regardless of their actual return, and it directly impacts pension eligibility and payment levels. The Treasurer indicated that the freeze would benefit more than 870,000 people.

In the context of the current cost of living crisis the decision can be understood, but the Treasurer had previously indicated that the deeming rate should broadly reflect changes in the cash rate. The cash rate now stands at 4.35% and has increased significantly in the last 12 months - see the chart below comparing the deeming rates (above and below threshold).

Why be concerned? Because the Government is providing a substantial indirect benefit to pensioners that appears more driven by politics than good management/economics and there is the question of generational equity and whether this just "kicking the can down the road", which is very much a feature of modern politics. These type of "benefits" can also be distortionary - for example the Government has maintained the interest rate for the HEAS at well below market levels, presumably to boost take up, but they will at some point need to better reflect market rates - and that may prove a significant shock to participants.

And unless interest rates very suddenly reduce - which is unlikely in the absence of a recession - deeming rates will need to increase substantially in July 2025, unless the Government wishes to continue an indirect and substantial subsidy.

AustralianSuper - yet to prove that "bigger is better" - May 2, 2024

We have just updated our article on AustralianSuper, including the most recent investment performance information.

In short, Australian super continues to provide no evidence that being larger benefits members, whether we consider investment performance, the quality of member services or product innovation.

In many ways, it's unfair to use Australian super as a "lab rat" in this situation, because there is always going to be an intrinsic volatility in investment results, but it trumpeted the advantages of size - and when it comes to performance, they just don't seem to have delivered. This is an important issue when it comes to the government and community's attitude to further rationalisation in the Superannuation sector - and in particular whether fund mergers are really to the benefit of members or simply the funds themselves.

There should be more SMSF's being wound up - March 9, 2024

Why do we think that more SMSFs should be wound up - look at the chart below illustrating the member ages of SMSF members. Nearly 20% of all SMSF members are, according to the most recent stats issued by the ATO, 75 years of age and older. Given the complexity and costs associated with maintaining an SMSF, we think it's almost certain that many of these members could/should be moved to simpler, lower cost structures, and wonder whether this inertia is a function of need or advisers wishing to maintain fee income streams. At the very least, SMSFs should be regularly reviewed to ensure they continue to be "fit for purpose".

Increases to Superannuation Contribution Caps from 1 July, 2024 - February 23, 2024

The Federal government has announced that there will be an increase in concessional and non-concessional contribution caps.

The changes to the annual caps were expected and will apply from 1 July 2024 - with the standard concessional contribution cap increasing from $27,500 to $30,000 and the non-concessional contribution cap - which is four times the standard concessional contribution cap - consequently increasing from $110,000 to $120,000.

The Transfer Balance Cap will remain at $1.9M.

Super: Tax on Funds over $3M - October 12, 2023

In the early part of 2023, the government flagged an intention to introduce a new tax on superannuation funds where the balance exceeded $3 million. There is reasonably widespread support for limiting the balances in superannuation funds which are subject to tax relief - consistent with the view that superannuation should be used for retirement purposes rather than tax planning. What inflames the public perception is that a small number of funds, whose balances are in the tens of millions, enjoy very significant tax relief.

Legislation, if passed, would establish a new tax, known as a ‘division 296 tax’, with effect from July 1, 2025 which would give rise to an additional 15% tax rate on the earnings of super accounts over $3 million, proportionate to how much of their balances are over that threshold.

What is controversial about the proposals is that they would have the effect of taxing unrealised gains within superannuation, and there is no intention at the moment to legislate any indexation of the $3 million amount - with the result that the number of funds caught within the ceiling will increase inevitably over time.

We have argued consistently over the years that superannuation is economically unsupportable as currently structured - and therefore we don't have a significant issue in terms of the $3 million limit and the initial absence of indexation - a balance will eventually be found. The fact that the AFR is full of stories which include cardiologists concerned about the impact on their SMSF because they have included their medical premises within the fund really finds no traction in the broader community.

However, the proposal to tax on unrealised gains, seems unnecessarily complex with the potential to be inequitable. What superannuation doesn't need, even though this is confined to a relatively small group of people who are almost certainly receiving professional tax advice, is added complexity

MPIR Increases to 8.15%, no change yet to HEAS Rate - September 15, 2023

Often slightly overlooked as a benchmark rate, but the Maximum Permissible Interest Rate (MPIR) - which is the rate at which refundable accommodation deposits paid an entry to aged residential accommodation, are converted into daily accommodation payments (DAP), has increased from 7.9% to 8.15%.

This reflects a deceleration in MPIR, which reflects the broader interest rate environment, but nonetheless we have effectively seen a doubling in DAP over the last two years, and there is now a clear trend towards more individuals paying for residential accommodation through RADs, if the capital is available. In effect, to do otherwise would be to forego a guaranteed 8.15% return on the money.

Conversely, and it is incongruous, we have had the Federal government maintain interest rate on loans through the Home Equity Access Scheme (HEAS) at 3.95% since January 2022. There is now a yawning gap between the rates applying for HEAS loans and reverse mortgages in the general market.

The government may be suppressing the interest rate to well below market rates in an effort to increase the attractiveness of the scheme - that is acceptable, but it leaves entrants to the scheme exposed to significant increases when and if rates return market levels. We have no problem with the government being ultra-competitive, but these rates appear to be below even the government's cost of funds - which effectively means subsidisation and this can have a distorting impact.

A Public (lack of) Service - Home Care - July 14, 2023

Why do we rely upon for profit, not-for-profit and charities to deliver Home Care services?

From a government and public service perspective, outsourcing the delivery of public services offers a number of - many political rather than economic - advantages:

- you don't have to manage day-to-day delivery, just fund the services

- it allows you to do a "Pontius Pilate" if something goes wrong

- you can always fall back on the mantra that the private sector is more efficient than the public sector, and

- if any changes impact the employment of individuals, well that's not your problem

What about the flipside, the downsides:

- the government loses almost all track of what are actually costs to deliver services - and no number of spreadsheets or consultants will bridge the gap

- you lose the ability to manage these types of services and your reliance on the providers means that you become dependent on them, and

- you lose control of costs and that means there is a risk of provider margins expanding over time, perhaps at the expense of service quality

For perspective, let's look at the top five Home Care Package Providers, according to KPMG's Aged Care Market Analysis 2022:

| Provider | Organisation |

Government Funding |

| myHomeCare Group | Partnership between private equity firm Quadrant, RACWA and the Sue Mann family |

$219.3M |

| Australian Unity | ASX listed mutual company (ASX: AYU) | $167.0M |

| Uniting Care QLD | $148.9M |

|

| Uniting Care NSW + ACT | $88.5M |

|

| Silver Chain | $85.4M |

I am not sure that we should feel happy that there is enough apparent margin in Home Care to attract a private equity firm. Also, if you believe that having a substantial charity presence in the top five provide some assurance that there is fairness in the market, we have a tendency to support that view, but these are large charities very much run like businesses, and pay executives what would appear to be open market salaries. Charities are always a bit shy about executive remuneration, but both Uniting Care Queensland and NSW/ACT charities paid their "key management personnel" $6 million and $4 million respectively in 2022 - but are coy regarding exactly how many people are included in that group.

And what about the fact that as at June 2022 there were apparently 1407 Home Care providers - doesn't that guarantee competition. It might do, but we question why there need to be such a large number of providers - all of whom need to be regulated in some fashion to ensure probity and quality.

In summary, we doubt that Home Care outsourcing is generating any clear net benefits, and wonder why the public service couldn't take a more operational role in the sector - if only to ensure greater transparency. There are always going to be doubts about public service delivery, but we think there are substantial doubts about whether we are receiving value for money from the current arrangements. We must invest in some greater degree of operational capability in the public service; otherwise they simply become a simple, questionably effectual, funding utility.

Buying a car – perhaps a time to change your approach – July 9, 2023

History is replete with stories and jokes about car dealers in general, but a recent visit to several car showrooms suggests to me that things haven't changed much recently.

For good and bad reasons purchasing a new or nearly new car on retirement is often a rite of passage for many retirees - who are looking to set themselves up with a vehicle for the next five or 10 years, with most costs covered under warranty. What you will find is that many new car dealers remain arrogant, bolstered by continuing shortages in certain areas, and often as not trying to sell you a car that won't be produced in Bavaria or Aichi until sometime in February, with an (optimistic?) arrival date in July 2024 - with only $5000 down to secure the car! If you get involved in these, review the fine print very carefully in terms of what happens if there are price increases and the impact of delivery slippage.

And this may be a comment made throughout the ages, but there doesn't particularly appear to be any emphasis on providing value - particularly by "established" brands. That only seems to be the focus of new brands - it really was only the presence of the Korean brands in the market several years ago that the established brands began to offer reasonable warranty periods. In fact, BMW only moved to a five year warranty in late 2022.

Additionally, showroom prices seem to bear absolutely no relationship to the advertised Manufacturers Suggested Retail Price (MRSP) and we continue to pay for dealer delivery charges, in the thousands of dollars, when it is not clear what we are paying for, if anything?

The moral of the story? Once I have clearly determined what car I want to purchase I am going to be looking at the online car brokerage services rather than experiencing again the traditional showroom, which has clearly not moved with the times. I'm also going to look outside my tried and trusted brands, because they've changed too, and not necessarily for the better when it comes to value, reliability and indeed transparency. You may be mystified by Tesla and Elon Musk at times, but buying a car online for a clear price offers tremendous advantages over car dealerships where "confusing you" is all part of the sales process.

Finally, if you're wondering why car dealers aren't necessarily too enthusiastic about retirees wandering into their showrooms - bear in mind that they often make half their margin on financing a car. Retirees who don't need financing - and you should be very careful about indicating this before you've received a "walkaway price" - just aren't as attractive to the "shark pool".

A quick summary of changes happening on July 1, 2023 which are of interest to retirees - June 14, 2023

- The transfer balance cap (TBC), which is basically the maximum amount that you can have funding a tax-free income stream in Australian superannuation, will rise from $1.7M to $1.9 million on July 1 - basically as a result of indexation. The TBC available to individuals will however differ depending upon when they started their income streams - "it's complicated" and see our page on the TBC for more background. MyGov will also provide you with a precise TBC figure.

- The Age Pension thresholds, both in terms of income and assets - but not the age pension amounts payable - will change from July 1. The change in the thresholds, again a result of indexation, should allow more individuals to qualify for the pension, or qualify for higher partial pensions.. We now know by how much and who will be affected. The precise details are contained within our Age pension page and our Age Pension calculator will be updated shortly.

- From July 1 minimum annual super drawdown rates "return to normal" after being halved as one part of the response to the Covid 19 pandemic. Remember, these are minimum rates of withdrawal - you may withdraw more but, as usual, much depends on your individual circumstances as to whether this is warranted and rational.

Draft Strategy Report - Aged Care - May 30, 2023

The government has recently released a consultation paper, the Draft National Care and Support Economy Strategy, which begins a discussion around how Australia should best manage and fund the growing challenges around aged care. The major point picked up by the media is the suggestion that there should be greater user pays pricing - in other words, that pricing for aged care should reflect your financial situation, even more significantly than currently.

One of the comments reported in the media was from the Chief Executive of the Aged and Community Care Providers Association, Tom Symondson, with the following remark, "If you have a significant amount sitting in your super account why shouldn't you contribute more to your care."

Our immediate response to the Paper is:

- Demographic changes are slow-moving, eminently obvious and unavoidable - for more than five years we have called for significant changes in the funding of aged care.

- We view equity, or more generally, fairness, as being absolutely crucial in any discussion around funding, and to us that means:

- No problem in principle with a user pays environment.

- The financing burdens should not fall on younger Australians, the tax and other systems are already biased enough in favour of senior Australians

- As previously argued, we prefer that the majority of funding is generated on a national insurance basis, similar to the Medicare levy

- The government needs to be "braver" in terms of what assets it considers when determining an individual's ability to pay - in short, the family home needs to be considered, perhaps beyond a certain cap, for means testing in relation to both aged care and pension. Otherwise, we continue to have the absurd situation where those with investments in superannuation rather than the family home are discriminated against. As mentioned previously, it is not fair that individuals living in a multi-million dollar main residences continue to receive the age pension and other benefits and then leave those assets to family members on a tax-free basis, while being supported by the taxpayer. This is a triumph of politics over equity - particularly since there are now a variety of mechanisms to convert assets into income so these individuals can remain well supported.

- Finally, although the paper talks about the need to abandon looking at services from a silo perspective, much more needs to be done to simplify administration across age care, social services and taxation - otherwise, the enormous complexity will continue to drive inefficiencies. This is a situation where, as valuable as clear strategies are, the greatest value and increase in productivity will derive from hard, mundane work to simplify and make services more efficient - without the constant political need to demonstrate there are "no losers".

And, talking about inefficiencies, the Report indirectly illustrates the enormous threat posed to fiscal rectitude by the NDIS and its potential to crowd out other social programs. No matter how well-meaning a program is, it still needs to be affordable and have reasonable/objectively verifiable entrance requirements and budgets. With age care, verifiable entrance requirements clearly exist - but in the space of relatively few years, look how NDIS compares with aged care and remember there is no user pays principle with NDIS. This table is excerpted from the draft strategy report.

Disability Support Snapshot |

Aged Care Snapshot |

One in six Australians with disability, including one in four First Nations people with disability and 2.2 million women with disability.

Non-NDIS |

Commonwealth Home Support Programme

Grant funding agreements with providers. Home Care

Individualised funding assigned to the consumer. Residential aged care

Funding to providers based on residents’ assessed need. |

Aged Care Residential Accommodation - Budget Shuffle - May 18, 2023

In the 2023 Budget papers there was a line item, entitled, "Improving the Investment in Aged Care", including the following extract:

"The Government will temporarily reduce the residential aged care provision ratio from 78.0 places to 60.1 places per 1,000 people aged over 70 years. The reduction in the ratio reflects the increasing preference of older Australians to remain in their homes,and will save $2.2billion over 3 years from 2024–25.

This is not a small adjustment, it represents a 23% reduction in the amount of aged care accommodation expected to be required over the 3 years from 2024-25. That individuals prefer in almost all circumstances to remain at home rather than move to residential aged care is undoubted, but we have two concerns:

- As we mention elsewhere, residential aged care is rightly restricted to individuals who meet strict criteria - and it will usually be health concerns, including dementia, that see individuals move into residential aged care. Either the government has been too conservative in the past in terms of the number of rooms required to meet demand, and is now redressing this, or it has now found ways to address significant health issues in the home environment.

- This is a significant shift and more detail is required to substantiate the decision - and perhaps some discussion of whether the forward saving should have been directly credited to the Home Care budget rather than simply, "...redirected to the Government's commitments in the health and aged care portfolio."

The Objective of Super and taxing Large Funds - February 28, 2023

The current Labor government intends to legislate an objective for superannuation, and in the consultation paper recently released, the proposed wording is

"To preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way"

The Objective has a "boring but necessary" feel to it, but it has a number of consequences:

Firstly, the use of the term "preserve savings" suggest that the government intends to strengthen the focus on the use of funds only for retirement, and reducing or eliminating the capacity for superannuation to be accessed early. Early access is already difficult, but the issue has gained a high profile because of the recent access allowed to superannuation by the government during the Covid pandemic and because it is being increasingly accessed for a whole variety of health related reasons - even stomach stapling to address obesity issues.

Additionally, there are elements within the opposition Liberal party that would like to see superannuation used for residential property purchases. We think this is absurd in a market that is already overpriced - and given that most housing "initiatives" in the past have flowed directly into the pockets of how sellers through higher prices, and we see no reason to doubt that allowing access to super wouldn't have exactly the same result.

Secondly, the objectives indicate that super is for ".. a dignified retirement ....in an equitable and sustainable way". The objective is inconsistent with high-value super funds which have been used more as a tax haven than as a way of funding retirement. As we have said previously, it is absolutely essential that superannuation is economically sustainable in the long term.

Today the Treasurer announced that from 2025-2026 the concessional tax rate applying to future earnings on super funds with balances over $3 million would be 30% - which is double the current concessional rate of 15%. Fewer than 1% of all superannuation accounts have more than $3 million in them.

We support this change, and indeed wonder why a two-year interim period has been provided, 12 months would appear to be sufficient.

Because we believe that sustainability is absolutely important so that we can rely upon superannuation for the long-term, we also believe that the government should take the same approach when it comes to NDIS. There are few programs in the history of Australia that have been less well thought through and represent a potential bottomless pit of taxpayer money.

Currently, access to NDIS funding is often a lot less constrained than access to age care funding - that is inequitable; NDIS should not be an exception and should be subject to the same considerations regarding sustainability.

Inflation and a Lazy Economy - January 25, 2023

Perhaps no other section of society is more challenged and impacted by inflation than retirees, and particularly self funded retirees, given that individuals receiving the old age pension at least have the benefit of indexation - while self funded retirees retirees have seen their ability to maintain their incomes challenged by declining superannuation balances.

Anyone in retirement at the present time has seen (worse) inflation before, but it is something new to many Australians, and it may represent an opportunity to effect some very significant economic changes which have been disregarded over the last 20 or 30 years.

We believe both the economy and consumers have become lazy, and if we had to nominate a few areas to concentrate on for both government and consumers, it would be:

Competition Policy

It is inarguable that Australia's economy is too concentrated - we have too few firms in very significant areas of the economy to ensure that genuine levels of competition exist. The industries that come top of mind include, the banks, general insurance companies, supermarkets, car dealerships, airlines and utilities. The argument often put that a few strong competitors are better than a range of smaller competitors is simply a convenient farce. We should make it more difficult for mergers to occur and we should look to the ACCC to consider corporate break-ups where necessary.

Further:

- Don't support any government initiative which involves the private sale of a monopoly, whether it be a utility, Airport terminal, public transport system or, for example, a "birth deaths and marriages" registrar. Anyone who thinks that the consumer is better off with these sales is not lucid.

- Support greater transparency in every aspect of government - and do not support arrangements in which government information must be sourced through brokers on a fee basis. Government information should be considered public information, accessible freely, by default.

- Hold supermarkets and retailers accountable for price increase - they have spent billions on polishing brands which allow them to compete on anything but price comparisons; this needs to be resisted by intensive comparison shopping.

The Medical and Dental Professions

During the debate over whether the general practitioner (GP) industry was in crisis, the leader of the Pharmacy Guild apparently indicated that it was the fault of GPs themselves, who had become "too commercialised". We agree with that view, but it's slightly ironic coming from an industry that has relied upon government lobbying for years to maintain what are essentially restrictive trade practices around the location of pharmacies.

We think it is clear that the medical profession has become much more commercial over the last 20 or 30 years, and whilst many medicos maintain a largely vocational focus, there is a significant and potentially growing proportion that primarily seek to maximise their income. This should be recognised and we should review how the medical profession is regulated, and the role of the various surgical colleges in terms of how they impact the demand and supply of GPs and specialists. A similar approach should be taken in relation to dentists, and more particularly dental specialists, who are often overlooked because they do not fall within the parameters of Medicare.

Clearly, in many areas, "self-regulation" has proved to be "no regulation" - and in an area as complicated as medicine, where doctors have an almost a singular ability to generate demand, and individual clients have little leverage or knowledge, we should consider the role of government and transparency requirements.

Bear in mind that a concern over (increasing) "gap" payments is one of the reasons why self retirees maintain larger than required capital balances.

Tradies are a challenge

For every hard-working, energetic and resourceful tradie we see on the various reality programs on TV, there is the tradie that retirees regularly meet who can't be bothered providing a quote, has to be chased for a quote, doesn't arrive on time, "wouldnt work in an iron lung", carries out their work poorly, takes forever to complete a job and/or "charges through the roof".

Things are even worse than usual at the moment, as the building industry struggles to complete a backlog, but this is a long-term pattern, perhaps largely of our own making - trade training has been awful and we just haven't given enough emphasis to the importance of trade skills and management. The end result is that many retirees avoid calling tradies wherever possible short of an emergency unless there is a "tradie in the family".

Do tradies care - the good ones - yes, but how do you sort the "wheat from the chaff". It's not from going online in places like Hipages, what retirees need to do is leverage on their local networking skills and maintain shortlists of individual tradies who have a reputation for being good workers and charging fairly. Relationships with these tradies need to be fostered, prior quotes shouldn't always be required and payment should be made immediately if work has been carried out satisfactorily.

Groups should be happy to both exclude tradies and "customers" who do not do the right thing.

The "Objective of Superannuation" – January 19, 2023

The government, following a long period of consultation, will shortly legislate the "objective of superannuation". This is not, as it might appear, a simple existential argument and there has been furious debate within the superannuation industry about the issue, some seeking a narrow focus on providing for retirement benefits and others a wider focus, which would perhaps allow individuals to fund the purchase of houses.

If recent comments by the Assistant Treasurer are indicative, then the government will choose a narrow definition very focused on superannuation being for retirement benefits only, and one corollary of that decision may be to set financial limits on how much money can be held within superannuation funds and attract preferential tax treatment. In that regard, there are said to be several funds in Australia where the amounts exceed $100 million, and in total there are 11,000 Australians with more than $5M in their superannuation accounts.¶

Figures currently suggest that if the Government were to limit individual superannuation funds to a balance of $2 million, then the budget saving would be in the order of $3 billion annually.

On balance, we are supportive of a fair limit being placed on individual superannuation balances, perhaps in the order of $2.5M subject to that limit increasing to reflect inflation over time. It is very clear that funds with exceptionally high superannuation balances are not focused on providing retirement benefits, but simply providing a tax effective structure in which to hold investments.

In this context, we do need to be a bit wary about what is driving the approach of superannuation funds - seeing fund balances maintained until retirement suits their business model. However, we would have thought that very few suggestions are more inappropriate than allowing super funds to be used to purchase residential property. Australian house prices are already too high and any further flexibility would simply make things worse by feeding directly into prices.

Equitably funding quality aged care - political courage needed - January 7, 2023

The latest StewartBrown Aged Care Financial For the 2021/2022 financial year, shows that the majority of aged care providers are currently running at a loss and facing a myriad of issues - including their ability to properly staff their aged care centres. This is important because it suggests that the sector will struggle to cope with both an increasing number of individuals moving into aged care, driven simply by demographics in the coming years, and delivering necessary improvements in care standards.

Funding, or lack of funding, is very much an issue and one that continues to be hamstrung by the reluctance of any politician in Australia to properly address how "main residences" are treated both for the purposes of age care and the age pension. The fact is that both from an aged care and pension perspective we have individuals owning mult-imillion dollar properties who make little or no contribution to the cost of their (very expensive) age care. The value of those properties is then passed to their descendants often without any capital gains tax applying to the sale of the property and without these assets being actually used to support an individual's retirement.

We believe, as we have mentioned before, that equity requires a greater acknowledgement of the value of an individual's main residence - perhaps only above a base level depending upon where they live - in the means test for both age pension and aged care purpose. Otherwise, we again have the general "taxpayer" bearing an unfair and rising tax burden.

In general terms, we think it would be beneficial for funding in aged care to be the subject of a short, wide-ranging report by the Productivity Commission - with the scope of any report including how individuals should contribute to their own age care. We remain of the view that the use of refundable accommodation deposits (RADs) is both inappropriate and gives rise to wider economic damage by inhibiting spending during retirement.

National Seniors – "walking a fine line" – December 1, 2022

We regularly receive inquiries about providing content to SimplyRetirement - these range from obvious scams to well-known and well-regarded companies seeking to write and provide content for which we would receive remuneration. Legitimate companies always make clear that any content provided would be marked as "sponsored" but the clear intent, whether directly or indirectly, is that any information will be advertorial in nature and intended to steer business towards the writer/provider.

Many companies, particularly it seems in the financial space, have adopted the view that sponsored material is more effective in terms of converting clients than simply paying for advertising.

Thus far, we have refused all offers to provide sponsored "professionally written content" - simply because these companies are effectively trading on the reputation of the website or organisation - and unless you retain complete editorial control of content, and ensure that you are providing an objective perspective, you trade away your reputation. And reputation should mean everything.

That's why we are concerned that National Seniors, probably the pre-eminent retiree organisation in Australia, seems to have become very reliant on sponsored material for finance news content. Let's review the six finance news stories published on November 28 -

- Retire in the comfort and style of your own family home - Tagged as a "sponsored story" from Home Equity

- How do I apply for Life Insurance? - Tagged as a "sponsored story" from NobleOak

- Four reasons why people lose track of their shares - Tagged as a "sponsored story" from Investafind

- The 3-step plan to ease the squeeze

- How to create a budget tailored to your spending

- Can’t afford financial advice? Here are some alternatives to help you keep track of your budget

There is nothing wrong with the advertisers involved in sponsoring National Seniors stories, but if you continually mix up stories that are sponsored with those that are produced internally, then they necessarily blur together.

It is even arguable that an organisation such as National Seniors should not participate in providing certain services, even if they do so with the best of intents - and this includes offering access to term deposits and insurance. For example, how can you provide demonstrably objective advice or commentary around the "best" term deposits and life insurance if you directly offer them as a service or products - given that they are actually provided by sponsors, Auswide banking and NobleOak.

Australian Federal Budget: Items of Relevance to Retirees - October 26, 2022

Provided below is a short summary of measures announced in the incoming Labor Government's first Budget, released yesterday, of interest or importance to retirees.

- The Government will freeze social security deeming rates at their current levels until 30 June 2024.

- More people will now be able to make downsizer contributions to their superannuation, by reducing the minimum eligibility age from 60 to 55 years of age. The age requirement has now fallen from 65, to 60 and now 55 since this measure was introduced in 2018. The new age limit will have effect from the start of the first quarter after Royal Assent of the enabling legislation.

- The Government announced that they would extend the assets test exemption for principal home sale proceeds from 12 months to 24 months for income support recipients and change the income test, to apply only the lower deeming rate (0.25 per cent) to principal home sale proceeds when calculating deemed income for 24 months after the sale of the principal home.

- The Government confirmed that age and veterans pensioners would be eligible for a once off credit of $4,000 to their Work Bonus income bank. The temporary income bank top up will increase the amount pensioners can earn in 2022–23 from $7,800 to $11,800, before their pension is reduced,

- Confirmation that the income threshold for the Commonwealth Seniors Health Card would increase from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples. This change is currently in legislation before Parliament.

- From 1 January 2023, the maximum co‑payment under the PBS will reduce from $42.50 to $30 per script, a 29% reduction.

Time for a total Retirement Review - our (short version) "Wish List" - October 18, 2022

When it comes to the factors impacting a retiree's life, there are several significant drivers, and almost all are within the Federal Government's authority. They are, in no particular order:

- The tax system

- The superannuation system

- The social security system

- The aged care system, and

- The complete health system - Medicare and otherwise

All are overly complicated, which adds to operational costs and inhibits compliance, but when it comes to looking at reform, whether the in the area of retirement or otherwise, these sectors are usually considered in isolation - reflecting the fact that they are managed by separate Government departments.

If someone were given the opportunity to review retirement generally, these are some of the things that we would like considered – taking a "blue sky" approach - in order to provide a better retirement regime without necessarily increasing costs.

1. A Universal Pension

1. Introduce a universal pension, that's to say all retirees would have access to the aged pension, dismantling the asset and income tests and making the system much simpler- in much the same fashion as occurs in New Zealand.

How would this be funded:

- Consider introducing a minimum level of tax on superannuation income streams, or simply making income streams fully taxable, but providing a 15% offset to reflect the tax on contributions. There should be restrictions placed on the maximum size of tax advantaged superannuation schemes - there are super schemes that have been historically used for tax rather than retirement purposes.

- Limiting the capital gains tax shelter afforded main residences - and particularly in terms of the treatment of inheritances. Improve mechanisms allowing retirees to draw income from their equity in their main residence.

This approach should also reduce the amount of "gaming" that occurs around the means test and improve simplicity.

2. Remove RAD's

Revamp the funding mechanism for residential aged care accommodation, and removing refundable accommodation deposits (RAD's). These are material amounts ($400,000+) which self-funded retirees particularly feel the need that they have to "save" for in retirement - this inhibits spending, is not efficient And economically disadvantageous.. Given that only a certain percentage of retirees will need residential accommodation, this could be funded through an insurance product levied on individuals above a certain age.

3. More efficient and available Homecare

Australia has more people in residential aged care accommodation than comparable other countries - more emphasis needs to be placed on Homecare, and the factors driving the comparative early entry into residential aged care. Costs need to be looked at in great detail, and in particular the share of the budget being absorbed by "management fees". You only need to look at the proliferation of companies, often located in expensive high street locations, to wonder about the efficiency and cost of both the Homecare and NDIS programmes equally.

4. Review the delivery of Health Care and the role of the major participants

Retirees also maintain funds and also to provide a reserve against significant health costs - in other words the significant financial "gaps" that now exist within the healthcare system. Our concern that part of the reason for rising healthcare costs has been the fact that medical practitioners can influence both supply and demand in a fashion which is not allowed in other parts of the economy.

There have been clear recent situations which illustrate/confirm that at least part of the medical profession is driven almost entirely by remuneration, and that is a difficult situation to address where we are dealing with a complex service where the consumer can have little or no leverage. There deserves to be at least some assessment of whether we currently have the right balance in Australia when it comes to the provision of medical services – public and private - and whether services in countries such as Canada and the UK represent learning opportunities.

Investments: Nowhere to hide for Retirees – October 16, 2022

As the table below illustrates, there is no asset class for self-funded retirees that is currently providing any effective shelter, and any returns are being substantially undiluted by historically high levels of inflation. Real returns for balance superannuation accounts are tracking at -10.9% over the course of 12 months to the end of August, once adjusted for inflation of 6.1%, according to Rainmaker.

That doesn't necessarily mean that retirees should be looking to change their investment approach, or portfolios. As we mention elsewhere on the site, most people "spend a long time in retirement" and they can't afford not to be exposed to growth assets, and with that comes a degree of volatility. Remember, it was only two years ago that some super funds were generating annual returns of close to 20%. However, you do need to ensure that you have sufficient liquidity to see yourself through the "winter months", and don't need to sell off your investments for income.

The Direct and Indirect impact of High/Higher Interest Rates - 27 September, 2022

The very rapid rise in interest rates, coordinated by Central Banks across the world, in an effort to address inflation risks, is well known - but let's consider some of the direct and indirect impacts it is having on current and future retirees in Australia.

- Mortgage rates have increased significantly, and may reach 6% on a typical variable rate mortgage by the end of this year. Retirees currently have historically high levels of mortgage debt on retirement and this will have a direct impact on their cost of living - it will also impact decisions on whether to use any super they have to pay down mortgages. The increase in rates is likely to re-balance that decision in favour of reducing or eradicating debts as much as possible rather than letting superannuation run in parallel. Very few, if any, super funds are currently earning at a net of tax rate of 6%.

- The increase in rates will feed through into reverse mortgage rates, and eventually into the interest rate used on what is now called the Home Equity Access Scheme, previously called the Pension Loan Scheme. Both involve variable-rate mortgages and (much) higher long-term interest rates need to be built into any financial assessment - particularly as we're going through period where one direct result of higher interest rates is also lower property values. The net result is debt is compounding more quickly whilst property values are either stagnant, or in many situations reducing. Participation in these schemes does however need to be considered against a time-frame of 10 to 20 years - but bear in mind that it is not possible to go into "negative equity"under either of these schemes.

- Interest rates are the mechanism used to convert between capital values and income streams. In terms of age retirement, the MPIR is the figure used and it has just increased to 6.3%, see below, with further increases likely. The result is that it has suddenly become much more expensive to choose to pay for aged care accommodation through a daily accommodation payment (DAP) rather than through a refundable accommodation deposit (RAD). Given that very few investments are paying a guaranteed rate of 6.3%, there will likely be a move away from paying DAP's to paying through a RAD; if individuals or their families have sufficient assets.

The fact that the DAP can increase and decrease so substantially over such a short period of time, leading individuals to pay markedly different rates for occupying the same accommodation, depending upon what month they entered accommodation this year, just illustrates how ludicrous this approach is.

MPIR Rate Increases to 6.31% from 1 October - September 16, 2022

The MPIR rate will increase to 6.31% for the period October 1 to December 31, 2022 - reflecting recent substantial increases in base interest rates. The MPIR ss primarily used to convert refundable accommodation deposits (RADs) into daily accommodation payments (DAPs) and the change will see a substantial increase in DAP pricing - see the table below

| RAD = $400,000 | From | To | DAP | Annual Cost |

| MPIR = 6.31% | 1 October 2022 | 31 Dec 2022 | $69.15 per day | $25,240 |

| MPIR = 5.00 % | 1 July 2022 | 30 Sept 2022 | $54.79 per day | $20,000 |

The increase in MPIR was very foreseeable and we have already heard of instances where residential aged care providers have effectively tried to delay access to accommodation until on or after October 1. An individual's DAP rate typically applies for the entirety of their stay in accommodation and you can see that operators had a clear financial incentive to delay occupancy - effectively a 26% difference in daily charges.

The fact that there are these "cliff effects" in aged care pricing is an indictment of the system and another example of why aged care funding needs to be examined at the earliest opportunity. Meanwhile, this change will probably see a reversal in the trend towards the payment of accommodation by DAP, towards a greater proportion of payment by RAD.

Work Bonus Changes - September 3, 2022

On September 2, 2022 the Government announced that Age Pensioners would be able to earn an additional $4,000 in the 2022-23 financial year before it affected their pension payments - this would be effected through an increase in the Work Bonus, from $7,800 to $11,800

No legislation has yet been enacted and the Government has not yet provided any indication regarding whether the Work Bonus increase will apply beyond this financial year. When more details are available we will update the material below accordingly.

Remember, the work bonus only applies in relation to employment income, it does not extend to income earned through investments or other passive income.

Hearing Services in Australia - the role and performance of "Hearing Australia" - August 29, 2022

Hearing Australia is a statutory authority constituted under the Australian Hearing Services Act 1991 and the largest provider of government-funded hearing services in Australia. They currently provide about 290,000 Australians with, "a wide range of information, education, research and clinical services, including the fitting of hearing devices and follow-up services"*. This includes providing Government funded hearing services to:

- pension concession card holders

- recipients of Centrelink sickness allowance

- holders of a Department of Veterans’ Affairs Gold and White card

- National Disability Insurance Scheme (NDIS) participants

- children and young adults under the age of 26 years adults with complex hearing needs, and

- Aboriginal and Torres Strait Islander adults aged over 50 years or who are participating in Community Development Programs

As we mention elsewhere on the website, we are very concerned about the accelerating commercialisation of health services in Australia and are fully supportive of having government owned corporations providing health services - as long as they are competitive on a level playing field basis - because they provide a window into actual costs within the sector. They have the ability, directly and indirectly, to constrain the ability of other providers to "over price" products and services to clients.

However, this requires an effort to be transparent in terms of the pricing of the products and services they deliver and to be a market leader in terms of the quality and detail of information provided to clients. It is not adequate, as we have seen recently, to have hearing aids costing thousands of dollars individually, sold on the basis of a single sheet of paper with few or no technical details, to clients. Device manufacturers were not specified, and indeed devices were "re-labelled" vaguely as "Active, Social, Comfort and Everyday" so that it is not even possible for individuals to conduct their own comparative research. Even device performance was labelled, "Level 1, 2...5", without the benefit of those performance levels being defined.

Specification and feature sheets should be offered to the client, including specific device details and the audiologist should explain the differences between the hearing aids available, and the basis for any particular recommendation, using a comparative analysis. Whilst some elderly clients particularly may be happy to simply accept an audiologist's recommendations, nevertheless the process itself is important.

Market share data seems extraordinarily difficult to obtain the hearing industry in Australia, but the concern is that having a government owned operator with a large market share, leads to a comfortable, complacent organisation rather than one focused on transparency and vigorously leading and improving industry behaviour.

*Hearing Australia Annual Report 2020-21

Super Consumers Australia - New Alternative Retirement Savings Targets - July 27, 2022

Super Consumers Australia (SCA) have recently released a new set of retirement savings targets, effectively as an alternative to the Australian Superannuation Funds Association (ASFA) Retirement Living Standard, which has been in widespread use over the last decade or so.

The SCA and ASFA standards are similar in the sense that they both look at retirement savings required for singles and couples who own a home without a mortgage, on the presumption that the age pension will apply in certain circumstances, but differ quite significantly in terms of the methodology attaching to how the various savings levels required are calculated.

There has always been a concern that savings targets produced by the superannuation industry may be biased towards larger lump sums, but regardless it is healthy to have another set of published targets to which individuals and couples can refer when assessing the adequacy or otherwise of their savings for retirement depending on the income they target.

There is one aspect of SCA's approach that we find fundamentally attractive, and that is a focus on providing retirees with the confidence to spend, rather than save in retirement. However, as we mention elsewhere, we believe there are some structural impediments that make retirees adopt a more conservative approach than should be necessary when it comes to retaining capital - and that includes the high profile attaching to retirement accommodation deposits (RAD's).

In the mindset of many retirees, even though most will not move into aged care accommodation and despite the ability to pay for accommodation on a daily basis (DAP), a certain amount of capital needs to be set aside to pay for RAD's - on average over$400K per individual. The simple result is that superannuation is then often passed on as an inheritance rather than spent during an individual's lifetime. Age care accommodation funding needs to move to an insurance model or based on tontines - with premiums paid by retirees.

The tables below provide the new SCA savings targets for two groups, pre-retirees and retirees, to age 85 and 90, and we have also provided a link to download SCA's Consultative Report: Retirement Spending Levels and Savings Targets, released in March, 2022.

Super Consumers Australia: Consultative Report: Retirement Spending Levels and Savings Targets - March, 2022.

Capital Gains Tax Exemptions and Discounts - Who really Benefits? - July 25, 2022

I think there would be few Australians who would argue that the economy is too focused and dependent on residential housing - it borders on a national obsession and does not support a productive allocation of capital in the economy. Unfortunately, any move to restructure a taxation, and particularly the fulsome capital gains tax exemptions around main residences, appear to be beyond the talents of our current politicians.

It has been said many times, but the chief beneficiaries of capital gains exemptions and discounts are those who hold the wealth in the economy, and they tend to be older Australians - so this is often characterised as a battle between young and old and vested interests. Certainly, it is our view - unusual from a website focussed on advice for retirees - that older Australia disproportionately benefit from the current tax system compared to younger Australian and the imbalance needs to be addressed as a matter of equity.

Additionally, who really benefits from these capital gains tax discounts and exemptions - other than property developers - if they largely generate higher asset values which need to be financed by higher (and longer term) mortgages for most of the population, and debt which increasingly stretch into retirement.

From data extracted from the 2021 and 2001 censuses by the ABS and analysed by The Sydney Morning Herald and The Age, it is apparent that 20 years ago, more than one in five 35 to 44-year-olds owned their home outright. In 2021, fewer than one in 10 in that age group could say the same, and amongst 55 to 64-year-olds the proportion of mortgage holders had more than doubled, rising from 15.5 per cent to 35.9 per cent, and the number of people with a mortgage at retirement age or older has increased from 3.2 per cent to 9.6 per cent. See the charts below for more detail.

Tax breaks, combined with reduced interest rates, large migration programs (until relatively recently) and Government payments to new home buyers which have simply increased entry prices have all conspired to generate an unproductive, misplaced and unfair boom in house prices which ultimately benefits very few.

The Retirement Income Covenant - More Form Than Substance - July 2, 2022

From July 1,2022 all superannuation funds (other than self-managed super funds) are required to become more proactive in how they help retired members turn their balances into regular income. Called the "Retirement Income Covenant" (RIC) , fund trustees must now help their members balance three key objectives:

- Maximise their expected retirement income over the period of retirement;

- Manage expected risks to the sustainability and stability of retirement income over the period of retirement; and

- Have flexible access to expected funds over the period of retirement.

In other words, the RIC forces superannuation funds to move away from a preoccupation with the investment of super funds to assisting members with the efficient and flexible drawdown of the funds post-retirement. In essence, it has taken 30 years from the time superannuation became compulsory for attention to turn to the primary purpose of superannuation, which is to support member retirement.

If ever there was an issue, apart from recent national energy planning, that illustrates why a Government elected on a revolving three-year basis should not be tasked with long-term planning it is superannuation and retirement - the amount of money involved is too significant, and the issues too politicised, to guarantee an effective, efficient outcome.

The current practical impact of the RIC is to have superannuation funds searching around for annuity partners, on the premise that lifetime annuities are the most obvious (and available) "product" that fills the retirement income gap - at least in terms of sustainability and stability, if not maximising income and flexibility. The other result is that the past LNP Government's success in reducing financial advisor numbers by 40% and increasing fees by a similar amount has exacerbated a yawning gap in the ability of "middle Australia" to access professional advice around retirement.

We believe that the emphasis simply on retirement income is too narrow - there needs to be some broader assessment of how other changes, for example in terms of the provision of residential aged care and health care, might provide a more secure basis for individuals to live and spend more freely in retirement, without the need to retain large capital sums for "security" and to ensure that superannuation is used to support retirement, not as a means of passing inter-generational wealth at the expense of the broader community.

Preferably, management of this issue should be contracted to a body insulated from politics and staffed by numerate individuals without any gift for, or need to provide, "sound bites" - in effect an institution similar to the RBA.

Sharp increase in Daily Accommodation Payments (DAP) from July 1 - June 16, 2022

The Government has announced a sharp increase in the maximum permissible interest rate (MPIR) to 5% on July 1, up from 4.07% currently. The MPIR sounds obscure but it is the rate used to determine how much you pay as a daily accommodation payment (DAP) as an alternative to paying the lump sum refundable accommodation deposit (RAD). Moving from 4.07% to 5.00% effectively means that DAP's have increased - for the same accommodation - by 23%.

The impact is probably better illustrated by comparing the DAP payable currently - prior to June 30 - on a $400,000 room with that payable after July 1, 2022 - in the table below. Bear in mind that the MPIR remains static throughout a person's stay in aged care accommodation.

| RAD = $400,000 | From | To | DAP | Annual Cost |

| MPIR = 5.00 % | 1 July 2022 | 30 Sept 2022 | $54.79 per day | $20,000 |

| MPIR = 4.07% | 1 April 2022 | 30 June 2022 | $44.60 per day | $16,280 |

Over the past few years there has been a definite trend towards paying for accommodation on a DAP rather than RAD basis. Where there is capital available, particularly given adverse situations in the broader investment market, we expect that there will now be a trend back towards paying RAD given the effective 5% earning rate. Particularly if, as we expect, interest rates continue to rise and therefore the MPIR rises with them - it was only back in 2019 that the MPIR was 6%.

Prepare for Adverse Superannuation Returns - June 14, 2022

After what was a stellar year for many superannuation funds last financial years, a detiorating economic environment will likley result in a very different performamce for 2021/22. The funds have done their best to flag that returns of 20% are "not repeatable" but neveretheless many will be surprised by negative returns this year.

The Chief Investment Officer of AustralianSuper was quoted very recently as saying that Australia was headed towards a "material downturn", and specifically that AustralianSuper was on track to "post its first financial year loss in 13 years", with its balanced investment option down 0.83% in the financial year to June 9. The following Tuesday, June 14, the ASX promptly dropped 5% on the back of poor market news out of the US and significant potential increases in US interest rates.

Labor throws the Financial Planning Industry a lifeline - June 4, 2022

It is hard to express just how poorly the previous LNP Government managed reform in the financial planning industry over the last 3 to 5 years. The aspirations were fine, to improve the professionalism and probity of advice provided by planners, but a blizzard of red tape and confusing legislation resulted in just 10% of the Australian population receiving financial planning advice, down from 14% prior to the Hayne Royal commission. This was in concert with a 40% increase in the cost of advice - largely as a consequence of almost half of the financial planning workforce leaving the industry.

In a recent interview the new Financial Services Minister, Stephen Jones, has indicated that action will be taken shortly to remove some of the regulatory burdens and review the requirements around professional qualifications, in an effort to try and forestall more retirements from the industry. All good news, particularly if an effort is also made to try and simplify - even perhaps at the expense of equity - superannuation rules and regulations,

Superannuation and retirement in Australia is just too complex - improving access to advice is obviously necessary, but the emphasis should also be upon simplification in concert with making an effort to improve the quality and delivery of financial education.

Federal Election Campaign Promises - Income Deeming and Seniors Concession Cards - May 4, 2022

During the course of the 2022 Federal election campaign both Coalition and Labor parties committed to:

- Maintaining the current deeming thresholds for 2 years to offset the impact of higher interest rates on pensioners, and.

- To raise CSHC income caps significantly from July 1, 2022. Those new caps would be:

- $90,000 a year for singles

- $144,000 a year for couples

- $180,000 a year for couples separated by illness, respite care or prison

Given that this website focuses on providing advice to retirees, the presumption is that we would welcome this news. Unfortunately, we do so with some reservations, given that we believe - as we have stated elsewhere - that the tax and social security system already leans too heavily in favour of retirees and holders of capital, if contrasted with the younger generation.

It is neither ethical nor efficient, for reasons which are political rather than economic, to have young people bear a considerably higher relative tax burden than retirees. At some point or other, and politicians run scared at the thought, there needs to be a re-set of the tax system to ensure that is fair and equitable across all the generations.

Specialist's Out-of-Pocket Fees - Time to Act - March 7, 2022

The Grattan Institute has just released a Report focusing on how to reduce out-of-pocket healthcare payments in Australia. And just to get some indication of the scale of the problem, read a couple of excerpts from the report below:

"Australia’s universal health insurance scheme, Medicare, is designed to make healthcare available to all, no matter how wealthy or poor. And mostly, it achieves this goal. Public hospital care is free, and the vast majority of services outside of hospital are ‘bulk-billed’ – meaning the patient pays nothing out-of-pocket. But Medicare is not perfect. Australia still relies more heavily on patients contributing to the cost of their care, compared to similar countries. In 2019-20, Australians spent a total of nearly $7 billion on out-of-hospital medical services and on medications listed on the Pharmaceutical Benefits Scheme (PBS)."

"Many Australians can’t afford needed care. In 2020-21, nearly half a million Australians missed out on seeing a specialist because of cost, and more than half a million deferred or did not fill a prescription because of cost. The people who need the most healthcare – the poor and the chronically ill – miss out on care most. This is bad for those individuals, but also bad for taxpayers and the economy. It makes people sicker, widens inequities, and puts further strain on the health system down the track."

The report identifies that specialists fees are a major cause of high out-of-pocket payments, with long public hospital waiting lists forcing individuals to go to private specialists. But as anyone who has sought specialist advice soon realises, specialist fees are unregulated and they typically charge significantly above the Medicare schedule fee. Apart from that, there is "only" the issue are perhaps waiting six months or more for an appointment and the first discussion with reception staff ensuring that you know that the, "consultation attracts a (sic) $200 gap, plus additional fees for procedures".

The Grattan report focuses on a number of concrete and reasonable measures that can be taken to reduce or blunt the impact of these additional costs on the community and the Report is worth reading in its totality.

We believe that a significant aspect of the problem around the specialist medical services relates to the issue of supply. At the present time the various surgical colleges in Australia - including general surgeons, ophthalmologists, anaesthetists and psychiatrists - effectively have monopoly control over the number of specialists working in Australia. Where else in the economy does this level of control on supply go unfettered by regulation - and we are long past the days when the medical fraternity could be universally guaranteed to place community health ahead of their commercial position. Dealing with many doctors today is more akin to a commercial transaction than any other experience.

So, the "supply of specialist" needs to be addressed on an urgent basis, perhaps by wresting away control from the Colleges, and in the meantime we suggest again that you talk to your GP in terms of receiving an "open referral" to a specialist, rather than one nominated by the practice. You shouldn't presume that referrals aren't driven by "networking" just as much as the proficiency of the specialist.

Important Superannuation Changes introduce additional flexibility for retirees - February 11, 2021

Recently legislated changes to superannuation, first announced in the 2021 Federal Budget, provide important additional flexibility to older Australians wanting to make significant additional contributions to superannuation. The changes provide significant strategic opportunities from 1 July 2022.

The legislated changes included:

- removal of the work-test requirement for non-concessional contributions (NCCs) and salary sacrifice contributions, for individuals aged between 67 and 75

- extended eligibility to make NCCs under the bring-forward rule to individuals aged under 75 at the beginning of the financial year, and

- extended eligibility to make downsizer contributions to those age 60 or over

The funding of Residential Aged Care needs to be reviewed as a priority - December 27, 2021

If you interview retirees in their 70s and 80s and asked them why, as is often the case, they continued to save in retirement or feel a need to maintain access to considerable capital, largely in the form of their home, they will often tell you it is to fund future residential aged care costs. Predominantly we think this is because of the large RAD fees publicly quoted - regardless of their ability to choose to pay through a DAP.