The Home Equity Access Scheme (previously Pension Loan Scheme)

On December 15, 2021 the Minister for Families and Social Services announced that the Pension Loans Scheme would be rebranded as the "Home Equity Access Scheme" and that from January 1, 2022 the applicable annual interest rate would reduce from 4.5% to 3.95%. This rate remains applicable, despite significant increases in interest rates in the intervening period.

Recent figures suggest a significant increase in the uptake of HEAS. That is a good thing, but in our view it is partly a consequence of the HEAS interest rate currently being a low 3.95%. This is probably even below the government's current cost of capital and presumably it is being left unchanged to make the scheme more attractive. If this presumption is correct, then this effectively represents a "honeymoon" rate which cannot continue indefinitely unless there is a transition to lower rates in the broader economy. We believe the rate should always be "competitive", but the rate should be managed to avoid circumstances where sharp changes are required.

The Home Equity Access Scheme (HEAS) in a Nutshell:

|

|

Eligibility extends to all Australians of Age pension age who receive an Age pension and those who are eligible to receive a pension but do not receive a payment because their assets or income are over the threhold. |

|

|

Through the HEAS, individuals can receive a fortnightly payment (combined pension plus HEAS loan) from Centrelink of up to 150% of the maximum rate of fortnightly pension (including basic pension rate, pension supplement, energy supplement, and rent assistance, where applicable). Consequently, a current maximum rate age pensioner who owns their own home could receive a loan of up to 50% of the fortnightly maximum pension, whilst a self-funded retiree owning real estate could receive a HEAS loan of up to 150% of the fortnightly maximum pension. |

|

|

You must have real property in Australia to provide as security against the loan and only a fortnightly income stream is currently available. You can however request an advance up to 50% of the maximum pension rate of your qualifying pension in any 26 fortnight period. You can take the full amount as one advance payment, or advance a smaller amount. However, you can’t obtain more than two advance payments in any 26 fortnight period |

| One advantage that the HEAS may have over normal reverse mortgages (and equity release options) is that the Government will generally accept any freehold property in Australia as security while other lenders will often restrict borrowing to major urban areas and standard houses, apartments and units. | |

|

|

The HEAS loan payments accrue as a debt to the Commonwealth with the maximum total loan available being a function of your age and the value of your property - although you can nominate exactly how much security you wish to provide. |

|

|

The current interest rate applying to HEAS loans is 3.95%, with the rate applying from 1 January, 2022. |

|

|

Any HEAS loan amounts received are not taxable and do not count in terms of the Age Pension income test. |

|

|

The HEAS scheme is delivered by Centrelink's team of financial information officers - who don't have to meet all ASIC and responsible lending requirements - which nevertheless provides some assurance of objectivity in terms of assessing the suitability of applications. Nevertheless, independent financial advice prior to commitment is considered essential; including the modelling of how the debt balance will increase over time. |

Eligibility Requirements

Eligibility for the HEAS now extends to all Australians of Age pension age, including those currently receiving the maximum rate Age pensions. Note that this eligibility does not mean, as some media reports have suggested, that everyone aged 65 and above in Australia may be eligible for the scheme. Eligibility for the age pension commences between age 65.5 and 67.

A frequently asked question is whether an existing mortgage will make you ineligible for the scheme? The answer is that while an existing mortgage will not disqualify you absolutely, the conditions of many existing mortgage contracts will often prevent an additional charge being placed on the property - contact any existing lender to first confirm your situation. And, of course, the existence of a mortgage will impact the net value of the property for the purposes of determining the maximum loan available. Regardless, it remains the case that all debt needs to be treated very conservatively, and that is particularly the case in retirement.

Note that the government has an online tool which assesses eligibility for HEAS.

Maximum Income Available

The Scheme provides that the maximum income available is equivalent to 150% of the maximum rate of fortnightly pension (including basic pension rate, pension supplement, energy supplement, and rent assistance, where applicable). The HEAS is made as a fortnightly payment and you can choose to get your loan payment each fortnight at one of three loan rates:

- the maximum amount which is 150% of the maximum pension rate each fortnight

- a smaller percentage

- a set loan amount that you choose.

Unless you get a set loan amount, Centrelink will automatically adjust how much you get whenever your pension amount changes. Remember, however, that whatever option you choose, your combined pension and loan payment can’t be more than 150% of the (current) maximum pension rate.

Maximum Borrowing Limits

The maximum loan available will depend on a number of factors:

- the age of an individual or, for couples, the age of the younger spouse or partner at the time the loan is granted

- the value of the property being used as security, net of any existing mortgages or loans, and rounded down to the nearest $10,000

- you can choose to exclude a portion of the security amount you offer and it will reduce the maximum loan you can receive.

For completeness we have provided the calculation behind the maximum loan amount available below - but Centrelink provides an online Loan Calculator that many people might find more approachable.

The maximum amount available is calculated using the same formula as that which applied to the previous Pension Loan Scheme:

Age Component x (Value of entire real estate equity or any lesser amount selected) /10,000

Note that the maximum loan available to is not static - it is recalculated once every 12 months after the participant's birthday (or, if applicable, the younger partner's birthday). But note that while the HEAS payments to participants will stop when the loan reaches the maximum loan amount the loan balance continues to accrue interest on a compound basis until the loan is repaid.

Age Component

The Age Component is based on the age of the individual or the age of the youngest member of a couple.

Age |

Age Component |

Age |

Age Component |

<55 |

1,710 |

73 |

3,460 |

56 |

1,780 |

74 |

3,600 |

57 |

1,850 |

75 |

3,750 |

58 |

1,920 |

76 |

3,900 |

59 |

2,000 |

77 |

4,050 |

60 |

2,080 |

78 |

4,210 |

61 |

2,160 |

79 |

4,380 |

62 |

2,250 |

80 |

4,560 |

63 |

2,340 |

81 |

4,740 |

64 |

2,430 |

82 |

4,930 |

65 |

2,530 |

83 |

5,130 |

66 |

2,630 |

84 |

5,330 |

67 |

2,740 |

85 |

5,550 |

68 |

2,850 |

86 |

5,770 |

69 |

2,960 |

87 |

6,000 |

70 |

3,080 |

88 |

6,240 |

71 |

3,200 |

89 |

6,490 |

72 |

3,330 |

90 and over |

6,750 |

The Cost

The HEAS is effectively a Government run reverse mortgage scheme, where the income withdrawn by the participant accrues over time and is subject to the payment of interest - which is normally paid off when the property against which it is secured against is sold. However, it currently only allows access to relatively modest lump sums (see below) and if that is your focus then a reverse mortgage or home equity scheme will be required and we would again recommend prior professional advice.

As mentioned above, from 1 July 2022, participants in the HEAS have been able to bring forward a portion of their fortnightly loan payments as a lump sum advance. These advances are capped at 50 per cent of the annual rate of the Age Pension, and any advance taken will reduce the fortnightly loan amount a person can receive over the following 12 months.

The current HEAS interest rate is 3.95% as mentioned above. Remember that these are variable rate loans and interest rates will almost certainly trend up in the medium/long term.

Examples

We have chosen to illustrate how the HEAS operates in practice by applying the scheme rules to Bob - a single, entirely self-funded retiree aged 70 living in a suburban house valued at $1 million - under two scenarios:.

1. Bob offers his complete house value as security, wanting to receive $1,000 per fortnight, and setting no limit on the total loan payments.

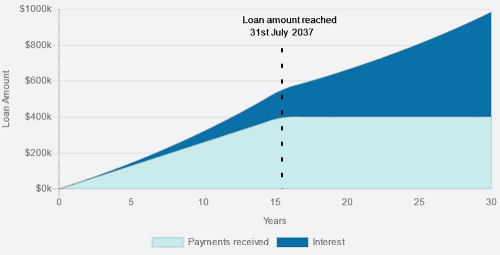

Commencing the loan at the end of March 2022, Bob would receive $1000 per fortnight until July 31, 2037 - at which stage he would have received $402,000 as loan payments, and owe Centrelink $555,280.61. It is important to understand in this context that the total amount of loan payments will only ever be a fraction of the total security provided against the loan - bearing in mind that the security offered must cover both payments and accumulated, compounding interest.

The image below - drawn from the HEAS Loan Calculator mentioned above - graphically illustrates what happens.

|

But it is also important to understand that the calculator is static. Unfortunately, and it clearly opts for simplicity, it does not allow you to model changes in the level of payment and house prices. Increases in the latter - also driven by compounding - will also increase the value of Bob's house over the period of the loan.

For example, let's look at the value of Bob's house after 10, 20 and 30 years based on an average 3% annual increase in house values:

Initial House Value |

10 Years |

20 Years |

30 Years |

$1,000,000 |

$1,343,916 |

$1,806,111 |

$2,427,262 |

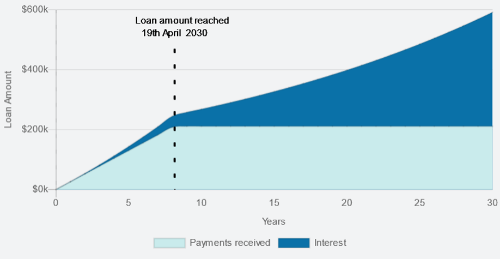

2. Bob offers his complete house value as security, wishing to receive $1000 per fortnight, but limiting the total loan payments to $250,000.

In this approach Bob decides to take a more conservative stance and limit his loan payments to $250,000. Commencing the loan at the end of March 2022, he would receive $1,000 a fortnight until 19 April 2030 – at which stage he would have received $211,412.59 and owe Centrelink $250,379.81. However, as mentioned previously, it's important to understand that interest will continue to accrue until the loan is settled and that is why the amount owed continues to increase.

|

HEAS and Negative Equity

There may be circumstances where, if there was a prolonged period of stagnant or falling house prices, coupled with increasing interest rates, that negative equity could arise - that is to say the value of the loan could exceed the value of the property offered as security. Elsewhere, legislation enacted in 2012 provided statutory protection against negative equity on all reverse mortgage contracts.

Unfortunately, the Government admitted in the 2021 Budget that the same protection had been NOT afforded HEAS borrowers and this would only change from July, 2022 - providing a "non negative equity guarantee" from that date forward with respect to both current and new loans.

Summary

Relatively recent changes made to the HEAS/Pension Loan Scheme are welcome. Although in practice few changes have been made to the mechanics of the scheme there are at least some online tools now made available. The Scheme provides more flexibility to individuals who are often described as "asset rich and income constrained" to access an income stream and improve their everyday living standards.

Many people are also much more comfortable dealing with a Government entity than with a private lender. Nevertheless, we strongly recommend that individuals seek independent financial advice before entering these arrangements - they are long-term in nature and can be complex. If there is one significant failing that continues to surround this scheme it s that easy access is not provided to competent advice around suitability in individual situations.

Please Note |

|

|

|

Specific advice to individuals regarding HEAS can only be provided by a financial planner with a credit license, and professional fees will apply in relation to any advice. However, financial counsellors would appear to be exempt from needing to meet the credit licence requirement as long as their services meet certain requirements. |

|

|

Bear in mind that for some individuals participation in a reverse mortgage scheme, with access to a lump sum, might represent a better fit in their circumstances. |

If you would like to arrange professional advice in relation to the above matters, please complete the Inquiry form below providing details and you will be contacted accordingly. You will receive a fee quotation in advance of any advice or services being provided.

| Please Note: If your circumstances are not complex and don't require paid professional advice then any queries in relation to the HEAS should be made directly to Centrelink. |